Debitum Network platform update: October statistics

Dear Debitum Network community we will present Debitum Network platform update,

Another month has passed and it is time to look at the stats from Debitum Network platform for October. It was great for us and we hope you enjoyed the earned interest investing in the assets on our platform. We saw a few records broken in a number of areas. A steady stream of users came, registered and started investing with us. Without further ado, let’s analyze the stats together. Oh, there is also a special offer for you at the end of the post!

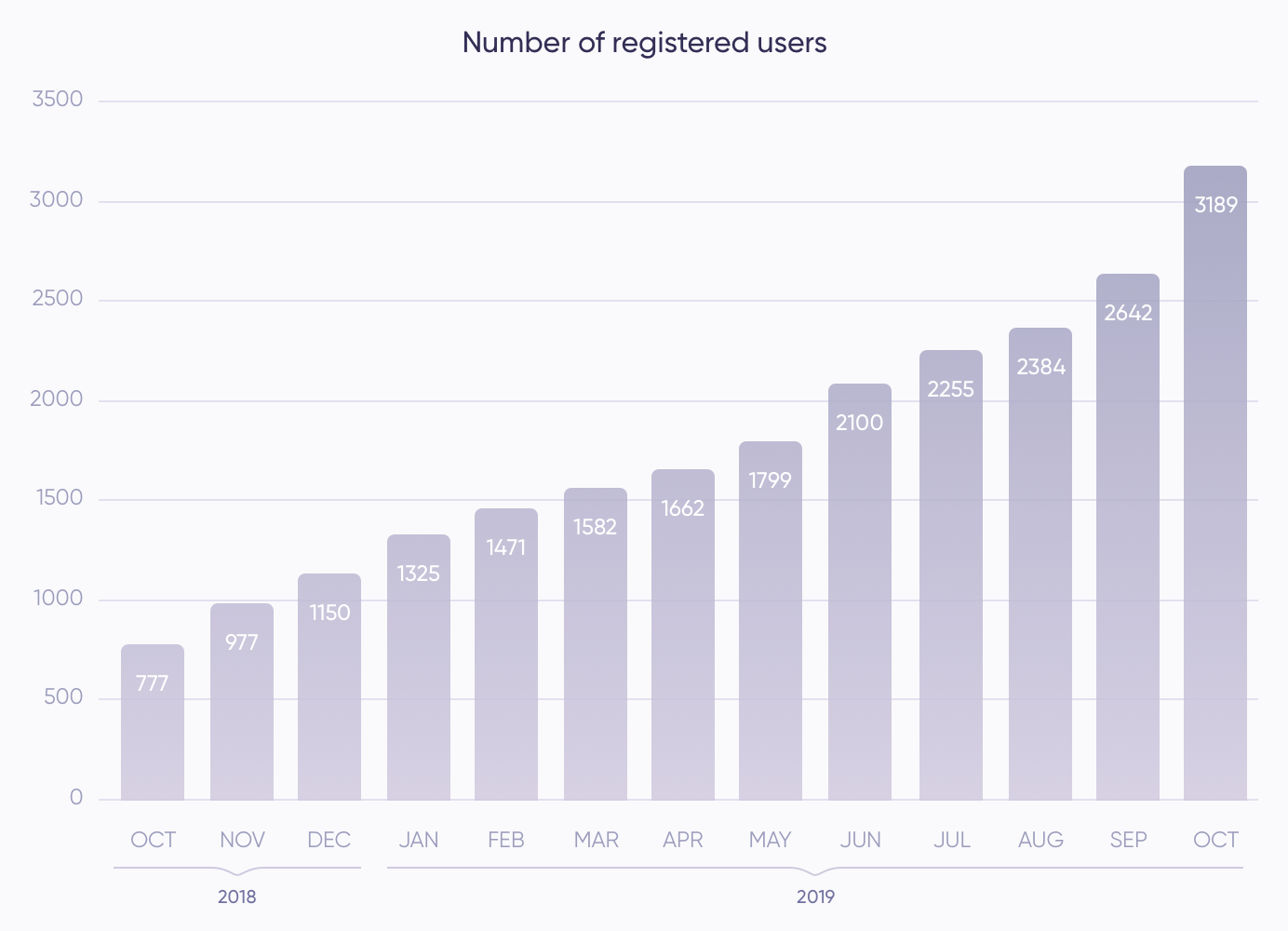

The number of registered users (activated)

A record number of users registered and activated their accounts last month. 547 new users joined Debitum Network family in October. The previous record was 522, a year ago, in September when the platform launched. The total number of registered users (who have activated their accounts) has risen from 2,642 to 3,189. This is a 20.7% growth in a month and 511% since the launch. We do expect a tenfold growth this year as we target specific geographical areas cooperating with bloggers and influencers who operate there. We are glad that the trust in Debitum Network platform has radically increased and more users invest with us. If you haven’t joined our platform you can do it in a few minutes, deposit and start investing right away.

Money deposited

The second record was made in the amount of deposits. The users added 282,819 Euros to their accounts and the total amount of deposits grew from 1,089,820 Euros in September to 1,372,639 Euros in October. It is a 25.95% growth in a month. We managed to reach 1 million Euro deposits within a year and expect it to grow ten times within the next year.

Debitum Network offers investors the potential to earn up to 15% annually, and you can make a deposit as many times as you want. The minimum deposit amount is 50 Euros (from SEPA accounts or British Pounds (GBP) from local accounts, and US Dollars (USD) from US-based accounts)). The minimum investment amount is just 10 Euros. All transactions in the assets are done in Euros.

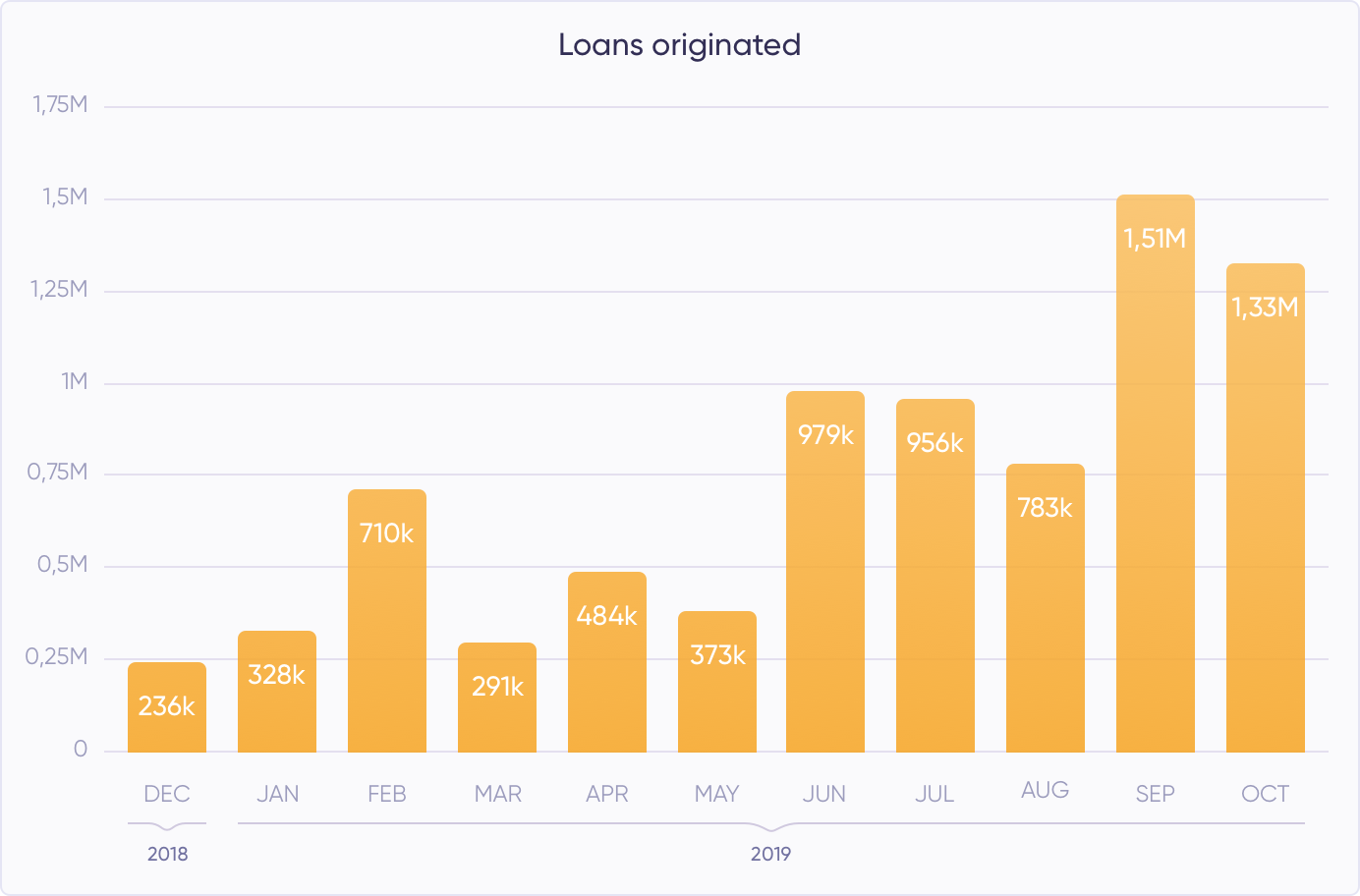

The amount of loans originated

After September, which was a record-breaking month for loans originated on Debitum Network, there was a minor decrease. However, the amount far outweighs any other month in terms of the volume of loans, except September. The total volume of loans reached 1.33 million worth of euros by the end of October. We expect even greater growth to pick up by the holiday season as we are in negotiations with a few new loan originators and will most likely onboard some by the end of 2019. Stay tuned!

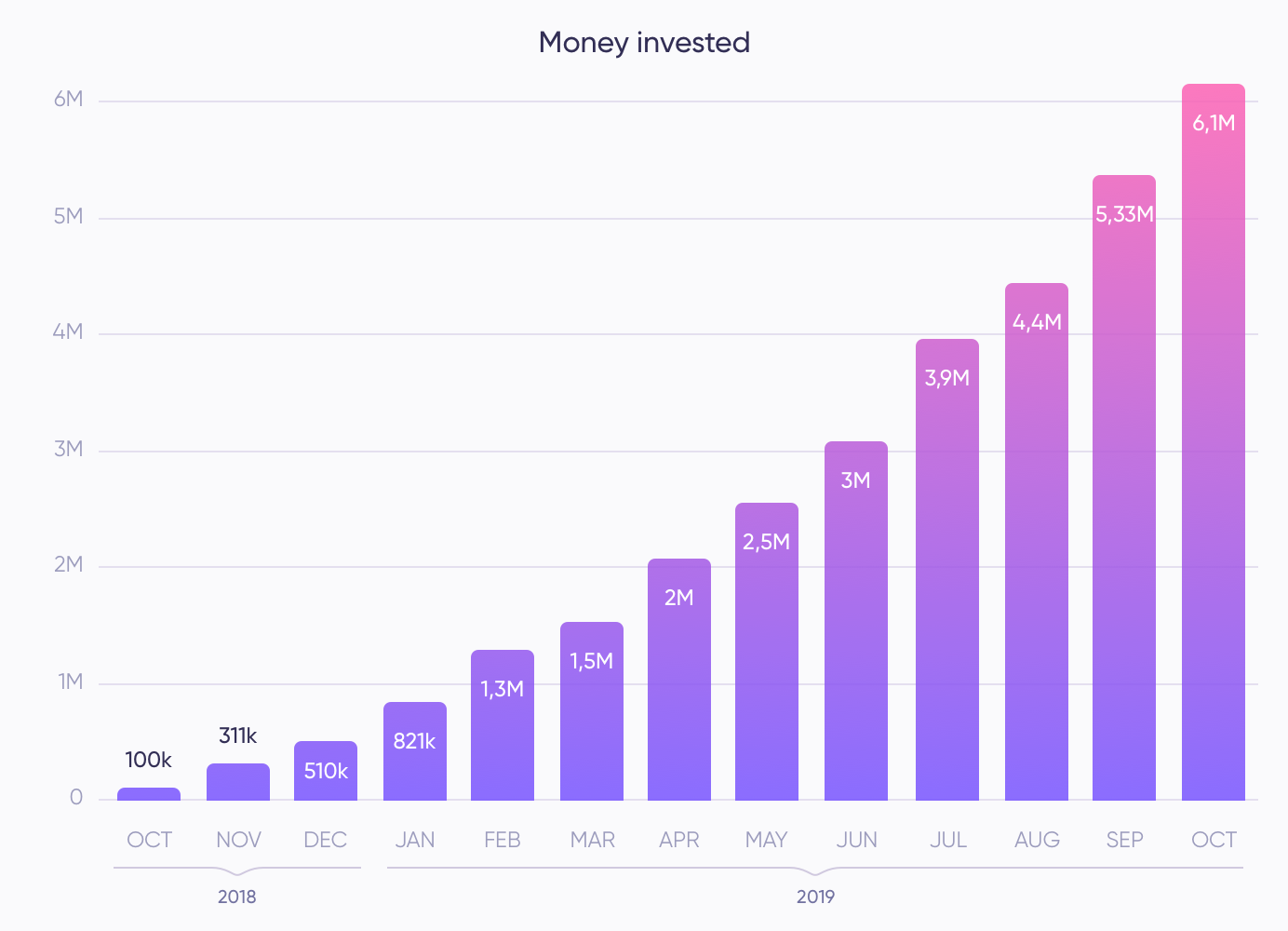

Money invested

Investments have dramatically picked up in September when the record was broken and the amount keeps steady in comparison to the first two quarters when we launched our platform. The total amount invested in the assets in October was 769,833 EUR. That is a growth of 14.43% in a month. For quite a while we have more than 1 million EUR invested in the assets at any given time. This is an excellent opportunity for investors to earn compound interest as they can reinvest their principal and earned interest when the assets they had invested in are repaid. We also crossed a 6 mil EUR milestone of total investments. More deposits and increased activity in investments will pick up when the portfolio of assets grow on the platform.

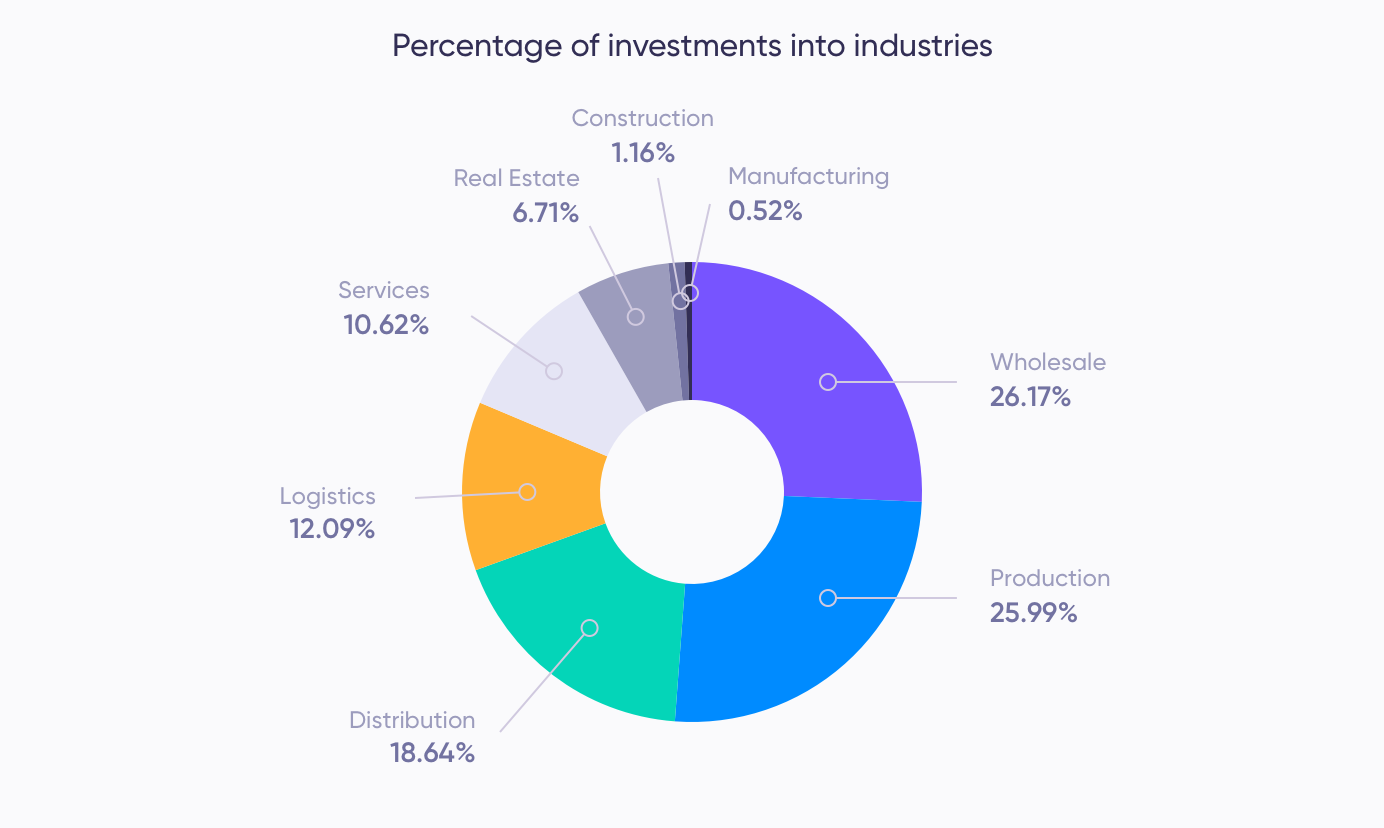

Most popular industries

The number of most popular industries expanded in September from 5-6 (previous months) to 8. In October, the number remained the same, which is really good. We expect over 10 industries with the onboarding of new loan originators in the near future.

The Wholesale industry assets have remained the most popular among investors for months. More than 25% of the total invested amount went to the assets of the industry. About the same percentage of investments went to the Production industry. The 2 industries covered slightly more than 50% of all investments. The assets of the industries have had the most attractive interest rates. The assets are short term in duration and that could be another cause for such popularity among investors.

A little over 6% was invested in the Real Estate industry assets. The assets come from our newest partner and loan originator Vihorev Investments and more than have of them have already been funded. These are test assets and most likely more will come when the initial 15 ones have been funded and repaid. They are long term and vary from 260 to 440 days. We always stress the importance of diversification, and Real Estate assets are an excellent choice to mix up short term investments with the long term ones. The interest rates for the assets are 9.5%-10%.

Money invested using an auto-invest tool

2 months in a row we saw a record broken in the usage of auto-invest tool on our platform. 239,507 euros were invested using the tool. That is a 37.8% increase in a month. There are obvious advantages in using the tool and a lot of investors use it now. You can simply create an auto-invest plan in a few minutes with the parameters of your choice and the tool will do the job for you. That is a job being done, without you doing the job! Do not miss another good opportunity and create a plan today. Then, enjoy compiling interest, which the tool will reinvest for you when the principal and interest are repaid.

Special offer of the week

The Special offer of the week comes from our newest partner and loan originator Vihorev Investments. The borrowing company owns a higher-end apartment building in the central part of Prague, the capital of the Czech Republic. The building has been fully renovated using shareholders’ funds (equity) and a loan from a local bank. Now, 22 apartments are sold and 18 apartments are left for rent by the borrower. It is expected that over the upcoming 5 years the project will generate a 148% return on equity from renting the apartments and have an average occupancy rate of over 75%. The asset is protected by the buyback guarantee. Furthermore, 100% of the borrower shares are provided as collateral. Sounds good enough? Take a look at the asset and if you like what you see, be sure to add it to your portfolio.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.