Features and functionalities on Debitum Network platform

Features and functionalities on Debitum Network platform

Debitum Network platform has been around for some time now. We started with the Abra 1.0 version where there weren’t as many features as there are now. In half a year, we added many new functionalities and features such as buyback guarantee, auto-invest, upgraded our risk valuation model, implemented exchange application to name a few. This blog post is meant to help investors familiarize with the benefits that they get from the features.

Filtering of Asset List

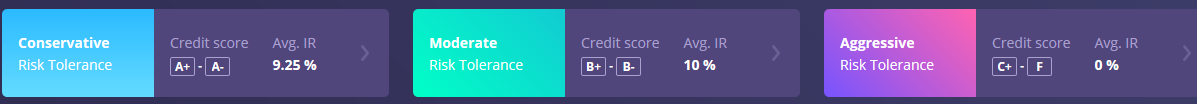

After logging in to our platform a user will see all the available assets he/she can invest in. The assets are categorized according to risk classes: conservative, moderate and aggressive to better match risk tolerance of a specific investor. Clicking on a category will filter out all the assets that belong to the group. This will save time unless one wants to go through all the assets manually. We have moved from risk categories expressed in numbers 1-100 to a better system of letters A+ – F removing any doubts for users which score is good 1 or 100, and widening the choice for selection and better defines risk category as well as the percentage of likelihood of default as described in this blog post.

Analysis of a specific asset

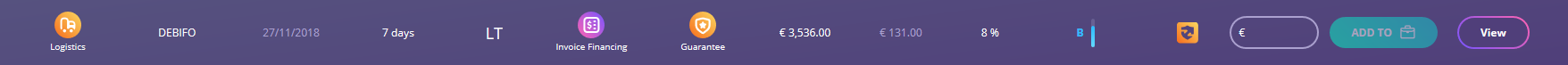

Let us look at one asset in more detail. This one has repayment in 7 days. On our platform, an investor can invest in any asset even if the repayment is 1 day away and earn interest for that day. We concentrate on loans for businesses as it is much safer than lending to private individuals that have a much higher probability to default on their loans than companies which may offer guarantees: personal (from owners), collateral (equipment, property and etc.), or invoices.

Most loans on the platform are short term, from 4 weeks to 3 months, which means that investors will have a fast turnover of their capital, make quick interest, and reinvest the balance and earned interest in other short-term loans.

Another thing that one may see is the necessary loan amount and how much of that is still available for investing. The current loan was for 3,536 Euros, but only 131.00 Euros are available for investment. Whenever an investor finds an attractive asset, time should not be wasted as loans are short-term and the entire amount may be covered in no time as in the case of our asset.

|

Annual interest and credit score |

The asset belongs to moderate risk category class and has credit score B with annual interest of 8%. Our aim, since the inception of the platform, was to upload the safest possible assets, which have been handpicked by our trustworthy brokers. Therefore, interest rates will be slightly lower than some of our competitors such as Mintos, Twino, Grupeer or Robocash. However, there hasn’t been a single default on our platform yet and our loan originators have much lower default rates than most other loan originators placing their loans on other p2p platforms. We do not upload assets that have F category and the worst scores that have been are C+, the score which still shows that the probability of default is very low. Thus, we claim that assets on our platform are much safer to invest in than on other p2p platforms, particularly those that have lots of personal loans such as Mintos or Bondora.

|

Buyback guarantee |

Extra security is added for the loans that have a buyback guarantee. The assets with the above-shown icon have it and it means that if the borrower is late with the repayment in most cases by 90 days (it depends on loan originator), the broker is obliged to buy back the loans with the outstanding principal and interest. This adds maximum safety for an investor to invest in the asset. Repayment on loans may sometimes be late for a variety of reasons, such as a seasonal effect of business a borrower is in, difficult market situation of a specific segment in the economy and many more. That’s why buyback guarantee serves as a safety cushion for investors’ funds and even if a borrower, occasionally, defaults on repayments, it does not influence investors’ returns significantly. In our previous post, we discussed about problems that investors’ face, when they invest on platforms that do not have a buyback guarantee and most of the loans, are personal or real estate, such as in the case of Lendy or Bondora that have a quite high default rates on their loans and no buyback guarantee.

Asset Detail View Window

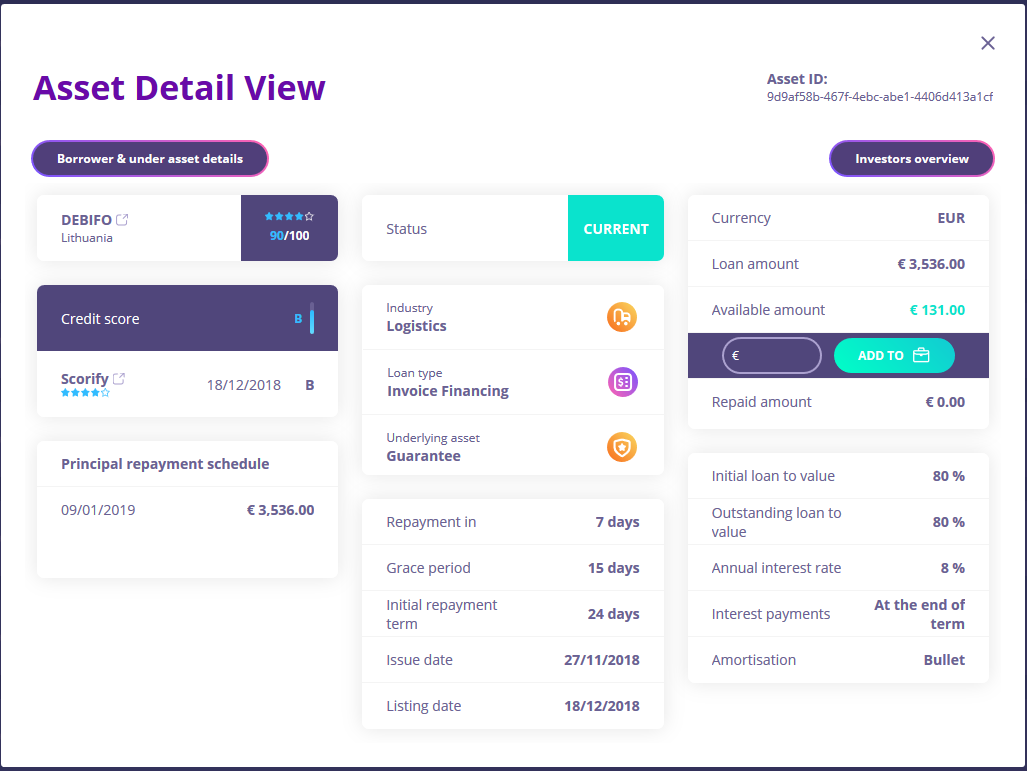

Investors can find info about a specific loan on ‘Asset Detail View’ in a nutshell. They can also invest in the asset from there by entering the desired amount. Amounts on our platform are flexible. The minimum is 10 Euros. You do not have to cover the entire loan amount.

Broker’s credit score is also displayed there, which should be of interest to any investor who wants to be sure that a loan originator (broker) is a reliable one and will stand by his pledge to provide the safest available assets or handle any issues arising with the borrower in a responsible fashion. In this case, Debifo is a loan originator. It is one of the biggest alternative finance companies in Lithuania, providing factoring services to Lithuanian SMEs. It received the Financial Service of the Year award in Lithuania in 2017.

Our partner, Scorify, that specializes in credit scoring and uses an econometric model to automatically assess companies and natural entities’ credit risk, forecasting of their solvency or of future sales, gave the asset B+ rating.

One can also spot, that the Grace period for the loan is 15 days. It means that a borrower may be late 15 days with the repayment and not get a penalty, but still have to pay outstanding principal and interest. When the period of 15 days is over and the borrower hasn’t repaid the loan, the loan becomes ‘LATE’.

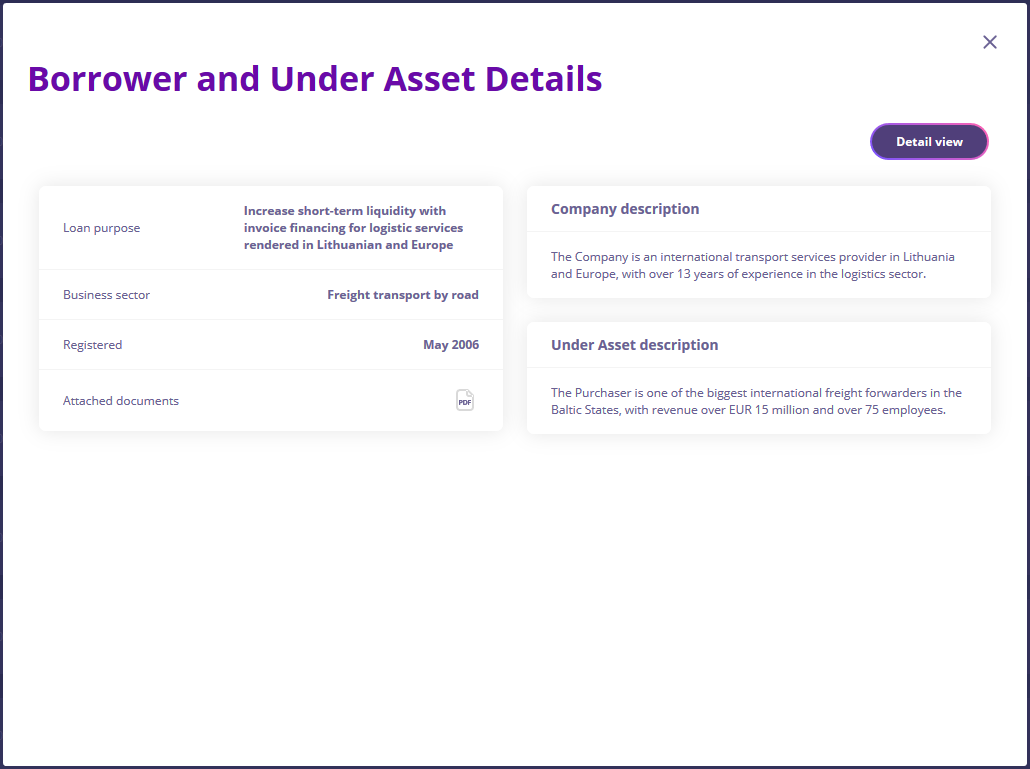

Borrower and Under Asset Details

‘Borrower and Under Asset Details’ window will provide more info about the borrower. You will find out how long it has been in business (in our example, since 2006), which shows that the company has long history operating in the industry and could be a safer option for investment. Our loan originators pre-select and upload only the loans from borrowers that have borrowed before and paid off the loans.

Info about market sector the company is in is also there, along with products or services the company provides, revenues, number of employees (the information for each asset is not always identical, but depends on what the loan originator has provided). In ‘Under Asset Description’ the info about the purchaser of invoices is available. These are very strong companies, leading market players with huge revenues and long years in business. Extra guarantees, such as personal, guarantees or collateral are provided there. This again should give an investor more confidence about the asset in question.

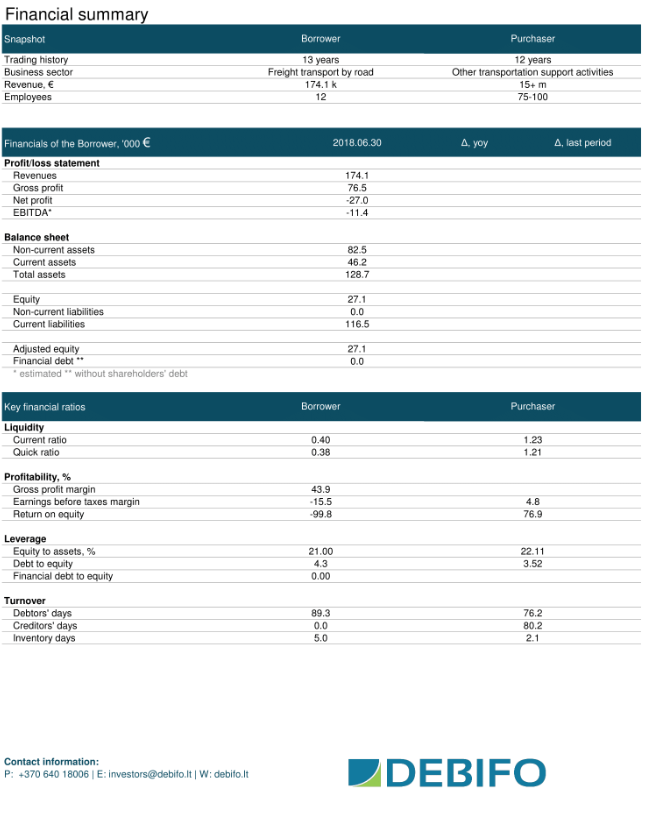

In this window, a loan originator may disclose additional financial info (financial summary) about the borrower and it can be downloaded as a pdf file. If you are a financial person and understand all the ins and outs about financial terms, this may give you more insight regarding the financial situation of the company. Below is the example of the summary (about the borrower) that a loan originator uploaded on our platform.

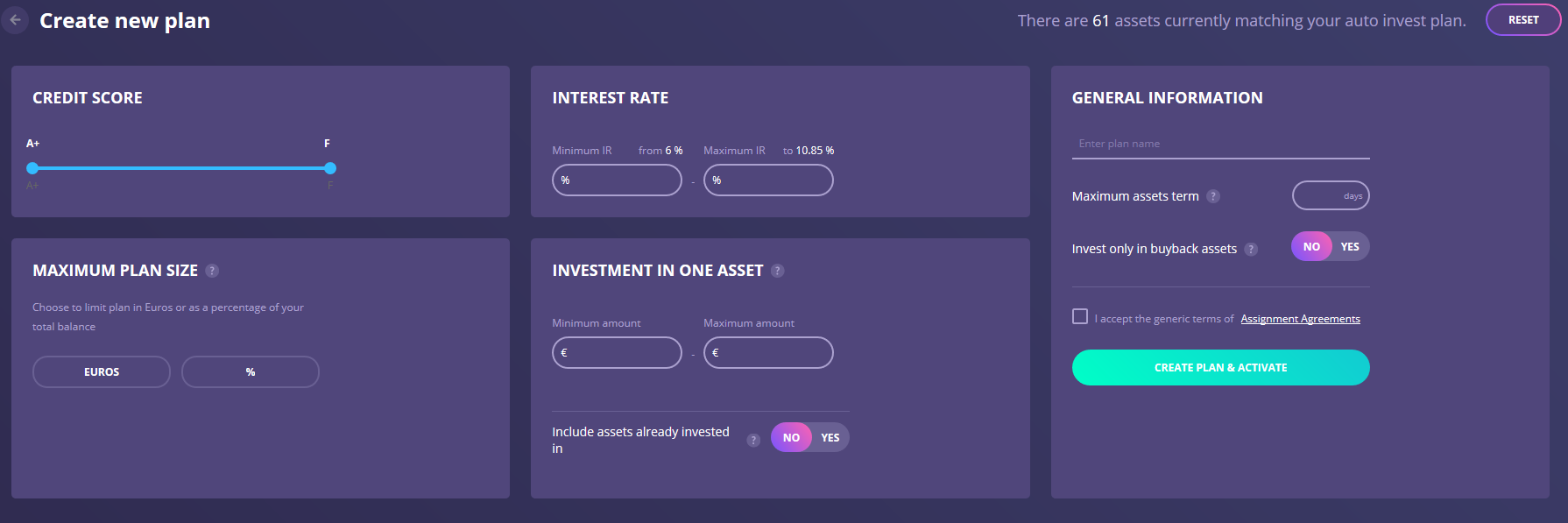

Just before the Holiday season, we enabled an auto-invest feature on our platform. Auto-invest feature is a program of a set of ‘buy’ orders implemented on a platform, which enables investors to automatically purchase loans at pre-set parameters at a date in the future. An investor is in full control of what loan parameters he wants to choose in order for a loan to be purchased. Any time investor has cash available in his account, the auto-invest feature will automatically purchase loans. This saves time for the investor and makes sure that cash is reinvested quickly, which helps to maximize interest earned. Thus, an investor can set the parameters for investing and forget about his investments as the auto-invest program will work on its’ own choosing assets to invest in according to the parameters.

My investments page

On my investments page, an investor can see the status of all the assets he has invested in. It is possible that a borrower may be late with the payments and if the repayment is late, it will be displayed on this page. This should not be of big concern to the investor, as the asset is shown is under the protection of the discussed buyback guarantee and in case it is late more than 90 days, the broker will have to buyback the loan and thus the investor’s invested funds, plus outstanding principal and interest will be returned. An investor can also see if the loan is in ‘Grace period’, what outstanding interest is or what penalty increments are for the borrower who is late with the repayment. A more detailed description of what happens when the loan is ‘Late’ can found in this blog post.

Ready to try our platform?

Debitum Network aims to become a leading online p2p and p2b fintech lending platform. We regularly add new functions and functionalities to increase the safety of investors’ assets, improve user experience, expand the number of partners offering services on the platform and even more improve quality of services for the end users. If you want to experience first hand the above-mentioned benefits of our platform, we want to invite you to register on our platform and start investing in available assets.

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.