New functions that help filter assets on Debitum Network platform

New functions that help filter assets on Debitum Network platform (Updated)

Our global lending platform Abra 1.0 launches on the 3rd of September. After the launch, investors from around the world can start onboarding, and, after authentication, begin investing in available assets.

Credit score and interest rate

Investment assets are loans and they are categorized or filtered according to credit score and an average interest rate for a specific period. These will be key filters, which an investor may use while selecting which assets to invest in. More risk-averse investors will probably concentrate on less risky assets and earn lower interest, while more aggressive ones will be able to choose riskier assets with considerably higher interest rates.

So, each asset or a group of assets, that you may want to own will show you the credit score and an average interest rate that you are going to make if you invest in those specific assets.

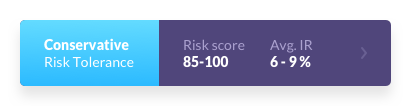

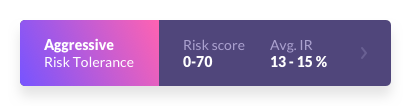

An investor should know, that the higher the risk score, the lower the risk and the lower the interest rate. The lower the credit score, the higher the risk and the higher annual interest rate.

Credit score will vary from 0-100, with 0 being the worst score, and 100 the best.

On Debitum Network platform, an investor will be able to see all available assets and filter them out according to a specific set of data.

Available portfolios

Assets will fall into following categories according to credit score and an average interest rate:

When you press portfolio, you can filter out the assets you want to omit and see only a specific category of assets, e.g., conservative. So, let’s say, there are 200 available assets. You press conservative portfolio, and you will get all the assets (let’s say 35) that are under this specific credit score category.

You press, moderate portfolio, and you get all the assets under this credit score category. Eventually, you can do that with assets that belong to the aggressive type of portfolio.

Alternatively, you can click on any specific asset manually and see its’ credit category and expected interest rate for a specific period of time loan is provided for.

Update of credit scores

Last November, we moved from risk categories expressed in numbers 1-100 to a better system of letters A+ – F removing any doubts for users which score is good 1 or 100, and widening the choice for selection and better defines risk category as well as percentage of likelihood of a default as described in this blog post.

Ready to start investing?

Disclaimer: Investments in financial products are subject to market risk and any investment should only be done with risk capital. The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.